Greece: 48 Hours to the End

Moderator: Community Team

Re: Greece: 48 Hours to the End

Ulf Poschardt - "Die Griechen haben sich rausgewählt aus dem Euro"

-

waauw

waauw

- Posts: 4756

- Joined: Fri Mar 13, 2009 1:46 pm

Re: Greece: 48 Hours to the End

waauw wrote:@patches I'm done making arguments against you. We're getting nowhere and honestly you seem to be writing an entire book. It gets tiring after a while.

The only arguments I'm making is that the ECB is going to take the losses on this and it is a serious problem for them because there is a whole line of other nations that are watching on with great interest as they are basically in the same boat as Greece.

Is it your contention that Greece is going to pay back its debt to the ECB?

is it your contention that Greece's debt is actually payable?

Is it your contention that there is no possible way Greece will receive debt relief?

When the ECB takes the losses she's eventually going to take over Greece anyway, what happens then? Will Spain, Italy and Portugal sit idly by while Greece gets debt relief or will they come clamoring to the ECB to demand their own debt relief?

I mean admit it, that's why you want to see the Greeks suffer as much as possible, to keep the rest of the PIIGS in line, right? Otherwise that's it for the ECB and the grand experiment that is the Eurozone.

Greece will receive debt relief. The only thing to see now is just how much pain the ECB wants to inflict on the Greek people. Only sadists and sociopaths say "the more the better". Sociopaths of the likes of Draghi who got the EU into this mess.

The Greeks are done with debt slavery it seems. Good on them I say. Maybe Draghi thinks if he keeps beating that dead hourse it'll get back up and win the Triple Crown. Whadda you think waauw? If Draghi keeps beating the dead horse that is Greece do you really think he'll get the ECB's money back?

-

patches70

patches70

- Posts: 1664

- Joined: Sun Aug 29, 2010 12:44 pm

Re: Greece: 48 Hours to the End

patches70 wrote:The Greeks are done with debt slavery it seems. Good on them I say. Maybe Draghi thinks if he keeps beating that dead hourse it'll get back up and win the Triple Crown. Whadda you think waauw? If Draghi keeps beating the dead horse that is Greece do you really think he'll get the ECB's money back?

I think you're putting too much responsibilty on Draghi. It's nice for Tsipras to follow the opinion of his own people, but so should the politicians in other countries. Reading newspapers and listening to interviews it's getting overly clear many people are growing tired of Greece. They have lost all credibility. Democracy would dictate several other countries should demand Greece's departure, just as democracy dictated Tsipras to to refuse the deal.

patches70 wrote:Is it your contention that Greece is going to pay back its debt to the ECB?

is it your contention that Greece's debt is actually payable?

Is it your contention that there is no possible way Greece will receive debt relief?

When the ECB takes the losses she's eventually going to take over Greece anyway, what happens then? Will Spain, Italy and Portugal sit idly by while Greece gets debt relief or will they come clamoring to the ECB to demand their own debt relief?

I mean admit it, that's why you want to see the Greeks suffer as much as possible, to keep the rest of the PIIGS in line, right? Otherwise that's it for the ECB and the grand experiment that is the Eurozone.

-Personally I'm fine with having a restructuring of Greek debt and possibly even writing off part of their debt. But this should ONLY happen outside of the Euro. The Greeks should still feel the punishment and get kicked out. If the Eurozone wishes to retain any credibility and leverage, the greeks need to leave.

-As for the other PIIGS, which is pretty much PIGS now as Ireland has recovered tremendously well, their debt situations are different. Most of their debt is private debt. It's not as easy to write them off. Our governments have the ability to write off greek debt ONLY because it has turned into public debt. Writing off too much private debt could result in destabilizing the entire financial sector.

-And yes, the greeks need to suffer ostensibly. It would be unacceptable to allow other nations to ask the same as Greece, especially since they are much larger and any such plan would be unfeasible. If ever they do make such demands, I hope the euro gets split up. Have all wealthy eurozone nations break away from the impoverished south.

Keeping Greece in the euro and writing off debt is the same as rewarding Greece for bad policy.

-

waauw

waauw

- Posts: 4756

- Joined: Fri Mar 13, 2009 1:46 pm

Re: Greece: 48 Hours to the End

FYI, the ECB has already declined to provide extra aid to Greece.

-

waauw

waauw

- Posts: 4756

- Joined: Fri Mar 13, 2009 1:46 pm

Re: Greece: 48 Hours to the End

patches70 wrote:When the ECB takes the losses she's eventually going to take over Greece anyway, what happens then? Will Spain, Italy and Portugal sit idly by while Greece gets debt relief or will they come clamoring to the ECB to demand their own debt relief?

They wouldn't do that. Italy never entered a bailout program in the first place, and Spain and Portugal have done fairly well in theirs. Why would they embarrass themselves and spook their creditors by stepping forward and asking for debt relief?

The reason that Greece's bailout terms have been so harsh is because Greece's systemic problems were greater, not because anyone was trying to humiliate Greece as an example to everyone else. The terms of Ireland's bailout were also fairly heavy, but there's been no ongoing drama in Ireland since then (as waauw points out, it seems silly to mention Ireland in the same breath as the Mediterranean countries any more).

The worries are not that onlookers in the rest of the Mediterranean would be inspired by the turmoil in Greece and decide that asking for debt relief would be a fun option for them as well, but that a Greek collapse would spread to Italy. That's why the EU, Eurozone and IMF have been investing so much in trying avoid a Greek default.

-

mrswdk

mrswdk

- Posts: 14898

- Joined: Sun Sep 08, 2013 10:37 am

- Location: Red Swastika School

Re: Greece: 48 Hours to the End

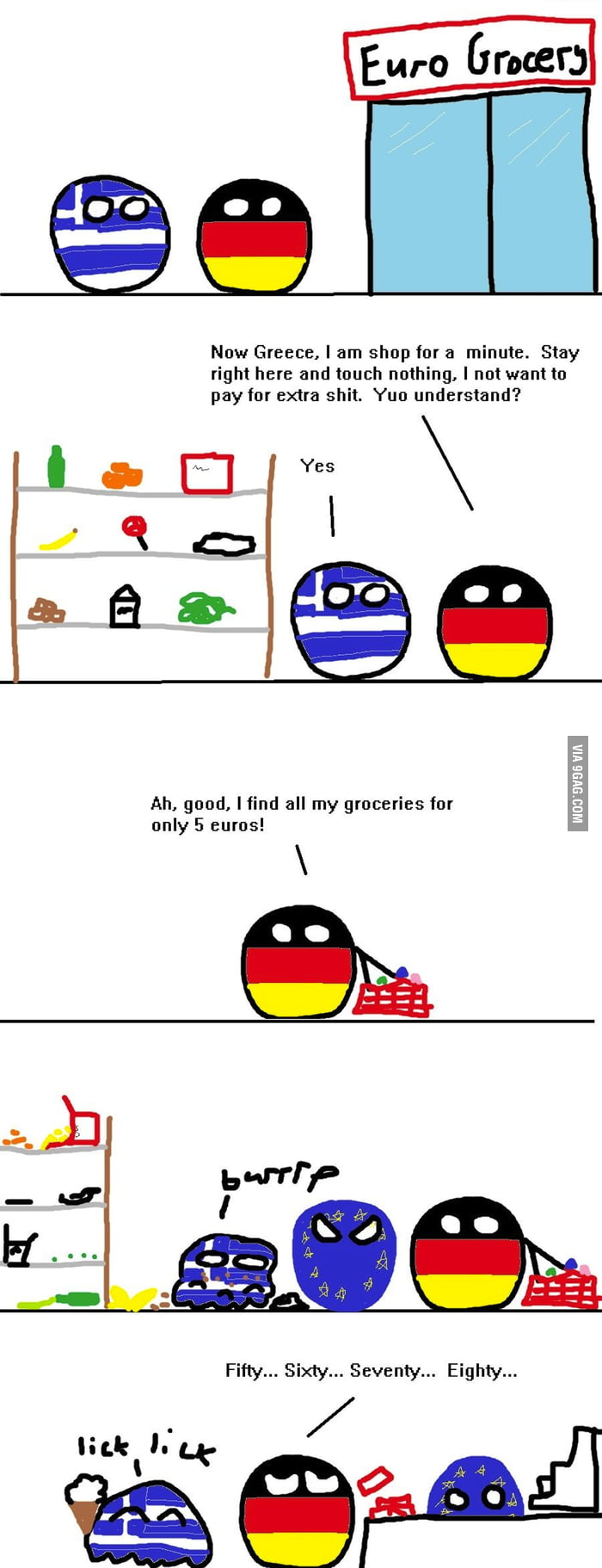

GoranZ wrote:Whole Greek story in 1 picture

-

waauw

waauw

- Posts: 4756

- Joined: Fri Mar 13, 2009 1:46 pm

Re: Greece: 48 Hours to the End

waauw wrote:-Personally I'm fine with having a restructuring of Greek debt and possibly even writing off part of their debt. But this should ONLY happen outside of the Euro. The Greeks should still feel the punishment and get kicked out. If the Eurozone wishes to retain any credibility and leverage, the greeks need to leave.

-As for the other PIIGS, which is pretty much PIGS now as Ireland has recovered tremendously well, their debt situations are different. Most of their debt is private debt. It's not as easy to write them off. Our governments have the ability to write off greek debt ONLY because it has turned into public debt. Writing off too much private debt could result in destabilizing the entire financial sector.

-And yes, the greeks need to suffer ostensibly. It would be unacceptable to allow other nations to ask the same as Greece, especially since they are much larger and any such plan would be unfeasible. If ever they do make such demands, I hope the euro gets split up. Have all wealthy eurozone nations break away from the impoverished south.

Keeping Greece in the euro and writing off debt is the same as rewarding Greece for bad policy.

You really think the bold italics would be a punishment?????

Your whole statement carries the arrogance and self opinion of the typical modern European

As for the red...I am breathless at your naivety.

-

Fruitcake

Fruitcake

- Posts: 2194

- Joined: Mon Aug 27, 2007 6:38 am

Re: Greece: 48 Hours to the End

Fruitcake wrote:waauw wrote:-Personally I'm fine with having a restructuring of Greek debt and possibly even writing off part of their debt. But this should ONLY happen outside of the Euro. The Greeks should still feel the punishment and get kicked out. If the Eurozone wishes to retain any credibility and leverage, the greeks need to leave.

-As for the other PIIGS, which is pretty much PIGS now as Ireland has recovered tremendously well, their debt situations are different. Most of their debt is private debt. It's not as easy to write them off. Our governments have the ability to write off greek debt ONLY because it has turned into public debt. Writing off too much private debt could result in destabilizing the entire financial sector.

-And yes, the greeks need to suffer ostensibly. It would be unacceptable to allow other nations to ask the same as Greece, especially since they are much larger and any such plan would be unfeasible. If ever they do make such demands, I hope the euro gets split up. Have all wealthy eurozone nations break away from the impoverished south.

Keeping Greece in the euro and writing off debt is the same as rewarding Greece for bad policy.

You really think the bold italics would be a punishment?????

Your whole statement carries the arrogance and self opinion of the typical modern European

As for the red...I am breathless at your naivety.

If they leave the eurozone and return to the Drachma, the first thing that'll happen is a drop in the Drachma/Euro exchange value. The Greeks already lost 25% of their income on average. A further drop would set them back even further. It would be easier to rebuild their economy but I don't think anybody enjoys losing out on income. Do you?

Secondly I didn't mention anything about how much writing off. Obviously the majority of the debt would still remain. The Greeks would still have to repay their debts. They would still have to keep their austerity measures. Keep in mind that if they return to the Drachma and their debts are still denominated in euros, they would be even more at the eurozone's mercy. They would be in the same situation as Argentina is with it's USD-denominated bonds.

As for the red part, I share the same opinion as what I've heard several other politicians mention in various countries. Currently it seems like the eurozone is too afraid to kick someone out and hold on to its rules. Expulsing Greece would at least recover that credibility a tiny bit. I'm not saying their entire reputation would be recovered. But it's better to show that in the end you're not afraid to expulse a nation, rather than its opposite scenario.

-

waauw

waauw

- Posts: 4756

- Joined: Fri Mar 13, 2009 1:46 pm

Re: Greece: 48 Hours to the End

waauw wrote:Fruitcake wrote:waauw wrote:-Personally I'm fine with having a restructuring of Greek debt and possibly even writing off part of their debt. But this should ONLY happen outside of the Euro. The Greeks should still feel the punishment and get kicked out. If the Eurozone wishes to retain any credibility and leverage, the greeks need to leave.

-As for the other PIIGS, which is pretty much PIGS now as Ireland has recovered tremendously well, their debt situations are different. Most of their debt is private debt. It's not as easy to write them off. Our governments have the ability to write off greek debt ONLY because it has turned into public debt. Writing off too much private debt could result in destabilizing the entire financial sector.

-And yes, the greeks need to suffer ostensibly. It would be unacceptable to allow other nations to ask the same as Greece, especially since they are much larger and any such plan would be unfeasible. If ever they do make such demands, I hope the euro gets split up. Have all wealthy eurozone nations break away from the impoverished south.

Keeping Greece in the euro and writing off debt is the same as rewarding Greece for bad policy.

You really think the bold italics would be a punishment?????

Your whole statement carries the arrogance and self opinion of the typical modern European

As for the red...I am breathless at your naivety.

If they leave the eurozone and return to the Drachma, the first thing that'll happen is a drop in the Drachma/Euro exchange value. The Greeks already lost 25% of their income on average. A further drop would set them back even further. It would be easier to rebuild their economy but I don't think anybody enjoys losing out on income. Do you?

Secondly I didn't mention anything about how much writing off. Obviously the majority of the debt would still remain. The Greeks would still have to repay their debts. They would still have to keep their austerity measures. Keep in mind that if they return to the Drachma and their debts are still denominated in euros, they would be even more at the eurozone's mercy. They would be in the same situation as Argentina is with it's USD-denominated bonds.

Not to mention that the point about Euro-denominated debts also applies to Greek businesses and individuals, presumably none of whom would be getting any debt write offs in a restructuring of Greek public debt.

-

mrswdk

mrswdk

- Posts: 14898

- Joined: Sun Sep 08, 2013 10:37 am

- Location: Red Swastika School

Re: Greece: 48 Hours to the End

DoomYoshi wrote:Dukasaur wrote:waauw wrote:Seriously what is it with everybody here thinking Greece is innocent and did not bring this upon themselves.

Why does everybody think europeans haven't shown even a shred of compassion? What do you think would happen if countries like Germany would hold a referendum on whether or not to keep supplying money to Greece and pass the bill to their own taxpayers?

Loaning money to Greece, means they themselves have to implement more austerity measures in Greece's stead. Do you honestly think Greece is the only european country with austerity measures? Even the richer nations need austerity measures.

This is what banks do. They give out easy credit to people in need of ordinary living expenses, knowing full well that not one man in a thousand has the fortitude to turn down easy money when he's desperate. Then, when he has accumulated enough debt that there is no longer any plausible way he could ever pay it back, he is in effect a slave. He can spend the rest of his life paying the interest on his debt, never able to get near the principle, never again having hope of moving forward, never having any chance of building up some capital and moving into the ruling class.

Something like 30 million people in North America are locked in that form of debt slavery, and something like 50 million more are damn close to it. Don't know what the numbers are in Europe, but probably not far behind. The banker is no different than the heroin pusher. He knowingly and deliberately supplies people with something that he hopes will lead to a lifetime of addiction and ultimately slavery to him.

At least when it happens to a person, he knows that one day death will set him free. But nations don't expire. If Greece was to accept this premise that it should continue to pay the interest on a debt that it has no chance of ever reducing, it would be condemning all of its citizens to slavery for all eternity, including not just those who spent the money in the past, and not just those voting today, but all Greeks forever, until an asteroid drop or rising sea levels or nuclear war would release them from their contract. It would be absolutely unconscionable for someone to put that kind of burden on their future generations.

The chance of default is inherent in every debt. If you don't like the possibility, don't lend money. If you're in the business of lending money, you know you are in the business of getting people hooked with short-term pleasure and setting them up for long-term pain, and you deserve whatever misfortune comes your way.

Cue, my old "Is consumerism worse than crack cocaine?" thread.

Yes.

“Life is a shipwreck, but we must not forget to sing in the lifeboats.”

― Voltaire

― Voltaire

-

Dukasaur

Dukasaur

- Community Team

- Posts: 28152

- Joined: Sat Nov 20, 2010 4:49 pm

- Location: Beautiful Niagara

3

3

2

2

Re: Greece: 48 Hours to the End

Everyone in this thread wrote:

-

mrswdk

mrswdk

- Posts: 14898

- Joined: Sun Sep 08, 2013 10:37 am

- Location: Red Swastika School

Re: Greece: 48 Hours to the End

waauw wrote:Dukasaur wrote:waauw wrote:

Sure you're right in that aspect? But what's the solution? Give up? Let the entire global financial system collapse? If that happens, the world will endure a crisis that has never been witnessed in history. Not at this scale.

If european banks fall, so do american banks, japanese banks, australian banks, etc.

Well, one possible solution would be to abolish fiat currencies entirely and move to a world of hard-backed money.

A second possible solution would be to stay with fiat currencies, but privatise them entirely. Get the stupid idea that governments "guarantee" the value of the currency completely out of people's heads. Any bank can print a bank note, but it is guaranteed only by that bank and whatever scheme it has going, and each note has a giant warning label "CAVEAT EMPTOR: This note might be worthless tomorrow!" or something along that effect. People could learn to deal with unreliable currencies, provided only that they weren't being brainwashed with this absurd idea that the government fairy "guarantees" that a dollar will be worth a dollar in perpetuity.

A third possible solution would be to stay with the current system, but make banking executives at every level personally liable for unwise loans they make, and make politicians at every level responsible for money they spend. You approved $12 billion for the purchase of frigates that don't float? There goes your parliamentary pension! Giuseppe at the ECF approved a loan to cover it? Say bye bye to his villa! Imagine a world where people treated public money as their own and took care of it as if there were real consequences for bad decisions!

Three perfectly workable scenarios, but none of them will be adopted. What will the politicos and the bankers cook up? I don't know, but I'm sure the taxpayers will get hosed. That's why we have the bad system we do in the first place -- because it helps ensure that wealth is transferred from the working taxpayer to the elites.

- Your first option: The problem with abandoning fiat currency is that the solution is not solved. History has shown governments will just end up manipulating the gold ratios(using goldstandard as a reference). It also makes governments prone to steal other nations gold in case of war and to confiscate all national reserves. It also leaves open the question, what type of goldstandard would you use? In the end you'd still be in a system similar to fiat currencies.

- Your second option: Hayek's idea of free market currencies is interesting, but it does bring along very negative effects. Instead of having the respective governments control the money, you'd have private bankers do so. After 2008 it should be plain they are hardly the better option. Secondly having a system of mulitple currencies within a country would have the opposite effect of fascilitating trade. The prime reason so many nations joined the euro was to get rid of currency exchanges, and the costs they come with. There is a great deal more to be said about this, but I think I've made my point.

- Your third option: So in the end you'll end up with a system similar to the american medical sector. Doctor makes a mistake? He gets sued and as a result medical fees skyrocket. Transferring this situation to banks, you'd have banks raise their interest rates on loans phenomenally as every single banker needs a compensation for the increased risks they're taking. Additionally your system is not very different from the eurozone-Greece situation. Market volatility is nigh impossible to predict. Instead of the Greek people being held responsible for their mistakes, you'd have bankers held up personally responsible for theirs. Keep in mind, bankers are just as human as any other person. Imagine someone gives a loan to a company and that company goes bust when a huge market crash occurs. The guy didn't mean evil, but gets screwed nonetheless. Hence the guy is for instance responsible for the loss of 50 million dollars and is in debt for the rest of his life for a nominal price of 50 million dollars. This doesn't solve anything, because most likely the guy won't be able to cough up the 50 million and will either dissapear or commit suicide. The losses would still be there and the system would still shake.

All in all, your suggested systems do have their strengths but they equally hold their own set of weaknesses.

1. Hard currency doesn't have to be gold. Plenty of economists have hypothesized hard currencies based on a "balanced basket" of all durable substances. Everything from gold to anthracite. A balanced basket should contain 20 to 30 materials, but you don't need to have the whole basket. If there are 25 goods including copper and anthracite, if you own a copper mine and I own a coal mine, we can each pledge our proven reserves against 1/25th of a basket, and swap them to a broker who will will combine them into a basket.

2. You didn't read very carefully. I made no allegations that private bankers would be any more honest than governments. They are scallawags of the same caliber. I have no fantasies about the stability of private currencies. The reason for going private is so that people will have realistic expectations and take steps to protect themselves. The problem with government currencies is not just that governments are crooked, but that people fail to correctly anticipate the crookedness of government. Despite mountains of proof to the contrary, most people cling to the idiotic notion that government has their best interests at heart. It is, unfortunately, part and parcel of our instincts as pack animals, to follow the leader. Since we have no easy way to rid people of their emotional ties to government, the best we can do is to take things out of the government's hands, so people don't get burned as often.

3. The American doctor example is a poor one. The crazy state of liability insurance in the U.S. is caused by an insane broadening of the definition of liability. In any case, I never said a banker should be liable for all failed loans; I said he should be liable for unwise loans. If you lend money to a country that already can't pay its bills, that is unwise. If you lend money to a successful farmer, but this year for the first time a crazy drought breaks out and he can't repay his loan, that was not unwise, but unlucky. Nobody can avoid all bad outcomes, but one can avoid predictably bad outcomes. There used to be a "Prudent Man" rule which was in Chapter One of all financial textbooks, and one thing a prudent man does is to avoid tilting at windmills and simply make no loans at all if no worthwhile opportunities appear. Unfortunately that rule has been abandoned in favour of "Portfolio Expansion At All Costs!" The latter obsession means that if there is no creditworthy applicant steps into your bank today, you run out into the street and thrust your money at anyone who will take it regardless of their qualities. This is the reason why, after 8 decades of financial stability, banks have been failing like crazy since 2004.

“Life is a shipwreck, but we must not forget to sing in the lifeboats.”

― Voltaire

― Voltaire

-

Dukasaur

Dukasaur

- Community Team

- Posts: 28152

- Joined: Sat Nov 20, 2010 4:49 pm

- Location: Beautiful Niagara

3

3

2

2

Re: Greece: 48 Hours to the End

Dukasaur wrote:1. Hard currency doesn't have to be gold. Plenty of economists have hypothesized hard currencies based on a "balanced basket" of all durable substances. Everything from gold to anthracite. A balanced basket should contain 20 to 30 materials, but you don't need to have the whole basket. If there are 25 goods including copper and anthracite, if you own a copper mine and I own a coal mine, we can each pledge our proven reserves against 1/25th of a basket, and swap them to a broker who will will combine them into a basket.

2. You didn't read very carefully. I made no allegations that private bankers would be any more honest than governments. They are scallawags of the same caliber. I have no fantasies about the stability of private currencies. The reason for going private is so that people will have realistic expectations and take steps to protect themselves. The problem with government currencies is not just that governments are crooked, but that people fail to correctly anticipate the crookedness of government. Despite mountains of proof to the contrary, most people cling to the idiotic notion that government has their best interests at heart. It is, unfortunately, part and parcel of our instincts as pack animals, to follow the leader. Since we have no easy way to rid people of their emotional ties to government, the best we can do is to take things out of the government's hands, so people don't get burned as often.

3. The American doctor example is a poor one. The crazy state of liability insurance in the U.S. is caused by an insane broadening of the definition of liability. In any case, I never said a banker should be liable for all failed loans; I said he should be liable for unwise loans. If you lend money to a country that already can't pay its bills, that is unwise. If you lend money to a successful farmer, but this year for the first time a crazy drought breaks out and he can't repay his loan, that was not unwise, but unlucky. Nobody can avoid all bad outcomes, but one can avoid predictably bad outcomes. There used to be a "Prudent Man" rule which was in Chapter One of all financial textbooks, and one thing a prudent man does is to avoid tilting at windmills and simply make no loans at all if no worthwhile opportunities appear. Unfortunately that rule has been abandoned in favour of "Portfolio Expansion At All Costs!" The latter obsession means that if there is no creditworthy applicant steps into your bank today, you run out into the street and thrust your money at anyone who will take it regardless of their qualities. This is the reason why, after 8 decades of financial stability, banks have been failing like crazy since 2004.

1. I know the system you're talking about and there is a reason why it's the BRICS-countries that urge such a system and not the western world. The BRICS are among the most resource plentiful countries on the planet. Europe, a continent low on resources would suddenly turn dirt-poor, despite the fact that we produce a lot of the worlds quality products like medicine, food and chemical compounds. Additionally most resources don't fulfill all the monetary needs:

- non-degradable: for instance food rots and copper rusts

- easily quantifiable: there are too many types of quality among diamonds which makes them unsuitable for monetary purposes. You can't say 2 ounces of of diamonds is worth more than 1 ounce, but you can say that about gold and silver since they get produced with a minimum of 95% purity. In most cases even 99,9% or 99,99%.

- easily storageable and transferrable: I don't think I have to explain that it would be a herculean task transporting and storaging most commodities on a macro economic scale.

- Limited supply: The most important aspect of both the supply of money and money substitutes is its limitedness. I don't think I have to explain that commodities are too plentiful and too easily dug up.

Money shouldn't be a production good nor a consumption good. The volatility has too many external factors and any monetary ratio would be unsustainable.

2. Taking money out of the hands of the government, means subjecting them to even more market volatility and uncertainty. As with anything in the private sector, crashes happen more frequently leading up to even more frequent money losses among businesses and individuals.

In the end human nature will triumph over all. The acceptance of Gold and Silver as money was an evolutionary step towards a common standard. It's a process of natural selection. Opening up the market for private currencies will always end up with an oligopoly or monopoly. The select few will still end up control the money flow. The only thing you're taking out of the equation is your voting ballot. This is historical fact as it happened thousands of years ago.

Don't get me wrong, the system has its strengths(which I didn't mention), but you have to take them with the weaknesses as well.

3. You're drawing a very fine, uncertain and subjective line. As with the social security system in europe, once you start it up, you end up with an endless discussion. Opening up bankers for broader liability is a touchy subject that has a very real possibility of spiralling out of control. There will always be people demanding even more liability. What you're suggesting is giving them the necessary push in the back to start whining incessantly.

You're also oversimplifying the "porfolio expansion" at all costs and pulling it to its extreme. The financial sector is arguably the most complex sector on the planet and it is subject to the volatility of every other sector both geographically and economically. Uncertainty is a guarantee in the financial world. Simply demanding to be prudent is not enough anymore in a world as vastly complex as it is today. There will always be people making mistakes that seem 'unwise' post-crash. Things always seem simpler in retrospect. Hence why Benjamin Graham's method of spread portfolio investment is so popular.

The biggest reason for the global economy running out of control ever since the Dotcom crisis is globalization, not risk-taking. The private sector has adapted to its environment, legislation has not.

-

waauw

waauw

- Posts: 4756

- Joined: Fri Mar 13, 2009 1:46 pm

Re: Greece: 48 Hours to the End

Also, what do you (Duk) mean when you say 'make bankers more accountable'? It's not like financial institutions currently operate in a consequence-free environment.

Was investing in Greece a bad investment on the part of private investors? They invested in a country with a strong credit rating whose debts were (correctly) assumed to be underwritten by the ECB. Those investors got their money back. Sounds like a reasonable investment to me. Compare this to the lenders who invested in the mortgage market and left themselves exposed to a housing bubble burst that left them with no way of recovering the loans they had made. Bad investment, and they took losses, shed jobs, some had to let themselves be bought out, and in Lehman Brothers' case they simply went bankrupt.

Was investing in Greece a bad investment on the part of private investors? They invested in a country with a strong credit rating whose debts were (correctly) assumed to be underwritten by the ECB. Those investors got their money back. Sounds like a reasonable investment to me. Compare this to the lenders who invested in the mortgage market and left themselves exposed to a housing bubble burst that left them with no way of recovering the loans they had made. Bad investment, and they took losses, shed jobs, some had to let themselves be bought out, and in Lehman Brothers' case they simply went bankrupt.

-

mrswdk

mrswdk

- Posts: 14898

- Joined: Sun Sep 08, 2013 10:37 am

- Location: Red Swastika School

Re: Greece: 48 Hours to the End

But this was the reality for the Greeks...

In the end this might turn out

Even a little kid knows whats the name of my country... http://youtu.be/XFxjy7f9RpY

Interested in clans? Check out the Fallen!

Interested in clans? Check out the Fallen!

-

GoranZ

GoranZ

- Posts: 2917

- Joined: Sat Aug 22, 2009 3:14 pm

Re: Greece: 48 Hours to the End

Mr Tsipras could not “put a gun to our head or a knife at our throats", said Belgium's prime minister Charles Michel.

http://www.telegraph.co.uk/finance/econ ... -exit.html

But, moments later, Obama ordered Europe to do what Tspiras says. And, just like that, the united EU resistance crumbled into a pile of dust.

Barack Obama has been forced to intervene in Greece’s protracted debt negotiations after European leaders openly threatened Athens with an imminent eurozone exit during a stunted round of emergency talks.

The US President spoke to Greek prime minister Alexis Tsipras and German Chancellor Angela Merkel as eurozone leaders gathered in Brussels on Monday - his first personal involvement in the crisis for months.

Mr Obama and Ms Merkel “agreed it is in everyone’s interest to reach a durable agreement that will allow Greece to resume reforms, return to growth, and achieve debt sustainability within the eurozone”, said a White House statement.

http://www.telegraph.co.uk/finance/econ ... -exit.html

Pack Rat wrote:if it quacks like a duck and walk like a duck, it's still fascism

viewtopic.php?f=8&t=241668&start=200#p5349880

-

saxitoxin

saxitoxin

- Posts: 13409

- Joined: Fri Jun 05, 2009 1:01 am

Re: Greece: 48 Hours to the End

DoomYoshi wrote:Total system collapse is the inevitable solution.

Without a doubt. There are however different types of collapses, methods to soften the fall and rebounce faster.

More importantly nobody has an idea when such a systemic crash would occur. It has been predicted for decades and it might just take another decade or more, or it could happen tomorrow. Politicians have to give it their all to forstall. When the music stops, the one holding legislature is higly likely to become the scapegoat. Executives and policy makers have little choice but to keep things running. Even announcing how bad things really are is not an option. Many economists right before the crash of 1929 purposely kept their mouths shut, because opening them would make them the instigator of market angst.

-

waauw

waauw

- Posts: 4756

- Joined: Fri Mar 13, 2009 1:46 pm

Re: Greece: 48 Hours to the End

Most of the eurozone gather behind Merkel and the Grexit option. Merkel's under pressure of her own party:

-

waauw

waauw

- Posts: 4756

- Joined: Fri Mar 13, 2009 1:46 pm

Re: Greece: 48 Hours to the End

DoomYoshi wrote:From 1969 until I was 10 the government of Canada never ran a balanced budget. Every Canadian owes about 34 thousand dollars if we were to split our public debt per person. The scary thing is that the private debt is about 60 thousand dollars. As terrible as the government has been at managing money, the average Canadian has been worse.

Total system collapse is the inevitable solution.

That 60k per person includes mortgages. My understanding is that people generally expect to pay off mortgages (much as they tend to pay off other debts too), so that's hardly an example of unsustainable consumerism gone mad.

-

mrswdk

mrswdk

- Posts: 14898

- Joined: Sun Sep 08, 2013 10:37 am

- Location: Red Swastika School

Re: Greece: 48 Hours to the End

DoomYoshi wrote:mrswdk wrote:DoomYoshi wrote:From 1969 until I was 10 the government of Canada never ran a balanced budget. Every Canadian owes about 34 thousand dollars if we were to split our public debt per person. The scary thing is that the private debt is about 60 thousand dollars. As terrible as the government has been at managing money, the average Canadian has been worse.

Total system collapse is the inevitable solution.

That 60k per person includes mortgages. My understanding is that people generally expect to pay off mortgages (much as they tend to pay off other debts too), so that's hardly an example of unsustainable consumerism gone mad.

There is no excuse for mortgages.

lolwut

-

mrswdk

mrswdk

- Posts: 14898

- Joined: Sun Sep 08, 2013 10:37 am

- Location: Red Swastika School

Who is online

Users browsing this forum: No registered users