1/ Following the confirmation at the end of today that the wires initiated on Thursday to remove balances were not yet processed, $3.3 billion of the ~$40 billion of USDC reserves remain at SVB.

https://twitter.com/circle/status/1634391505988206592

Is the Bitcoin bull run starting?

Moderator: Community Team

Forum rules

Please read the Community Guidelines before posting.

Please read the Community Guidelines before posting.

Re: Is the Bitcoin bull run over?

So much for the stability of stablecoin ...

Pack Rat wrote:if it quacks like a duck and walk like a duck, it's still fascism

viewtopic.php?f=8&t=241668&start=200#p5349880

Re: Is the Bitcoin bull run over?

Interesting

Last edited by HitRed on Sat Mar 11, 2023 8:50 pm, edited 1 time in total.

- mookiemcgee

- Posts: 5772

- Joined: Wed Jul 03, 2013 2:33 pm

- Gender: Male

- Location: Northern CA

Re: Is the Bitcoin bull run over?

saxitoxin wrote:So much for the stability of stablecoin ...

1/ Following the confirmation at the end of today that the wires initiated on Thursday to remove balances were not yet processed, $3.3 billion of the ~$40 billion of USDC reserves remain at SVB.

https://twitter.com/circle/status/1634391505988206592

WILLIAMS5232 wrote:as far as dukasaur goes, i had no idea you were so goofy. i mean, you hate your parents so much you'd wish they'd been shot? just move out bro.

Re: Is the Bitcoin bull run over?

Silver and Gold

- mookiemcgee

- Posts: 5772

- Joined: Wed Jul 03, 2013 2:33 pm

- Gender: Male

- Location: Northern CA

Re: Is the Bitcoin bull run over?

Stablecoin fully recovered. BTC back to 24k. Orange Coin loves gov't bailouts

WILLIAMS5232 wrote:as far as dukasaur goes, i had no idea you were so goofy. i mean, you hate your parents so much you'd wish they'd been shot? just move out bro.

Re: Is the Bitcoin bull run over?

That's like saying someone who goes into cardiac arrest, gets shocked five times with an AED, and then starts breathing again "recovered from their heart attack."mookiemcgee wrote:Stablecoin fully recovered.

USD Coin was resuscitated by Dr. Janet "There's a Small Risk of Transitory Inflation" Yellen. Which is similar to having a chiropractor perform open heart surgery on you. Do they know more than your 16 year-old neighbor? Sure. Should they be anyone's first choice to do open heart surgery? Definitely not. Did the perpetually confused, 81 year-old hospital administrator say that only chiropractors can do heart surgeries? For some reason, yes.

Pack Rat wrote:if it quacks like a duck and walk like a duck, it's still fascism

viewtopic.php?f=8&t=241668&start=200#p5349880

- mookiemcgee

- Posts: 5772

- Joined: Wed Jul 03, 2013 2:33 pm

- Gender: Male

- Location: Northern CA

Re: Is the Bitcoin bull run over?

Or it's like saying it was always redeemable 1:1 through circle, but since the feds just closed both of the banks (silvergate and signature) that previously offered circle a 24/7 route honoring this for exchanges over the weekends a bunch of people freaked out and created arbitrage opportunities for those with enough balls to no call their heart surgeon about a mole on their back. Regardless of Yellens statement, USDC was set to regain peg as soon banking hours resumedsaxitoxin wrote:That's like saying someone who goes into cardiac arrest, gets shocked five times with an AED, and then starts breathing again "recovered from their heart attack."mookiemcgee wrote:Stablecoin fully recovered.

USD Coin was resuscitated by Dr. Janet "There's a Small Risk of Transitory Inflation" Yellen. Which is similar to having a chiropractor perform open heart surgery on you. Do they know more than your 16 year-old neighbor? Sure. Should they be anyone's first choice to do open heart surgery? Definitely not. Did the perpetually confused, 81 year-old hospital administrator say that only chiropractors can do heart surgeries? For some reason, yes.

WILLIAMS5232 wrote:as far as dukasaur goes, i had no idea you were so goofy. i mean, you hate your parents so much you'd wish they'd been shot? just move out bro.

- mookiemcgee

- Posts: 5772

- Joined: Wed Jul 03, 2013 2:33 pm

- Gender: Male

- Location: Northern CA

Re: Is the Bitcoin bull run over?

If you want to learn more about the USG efforts to undermine the crypto ecosystem, and now 'save' USDC you can read about operation choke point... here one article

https://www.whitecase.com/insight-alert ... mber-banks

https://www.whitecase.com/insight-alert ... mber-banks

WILLIAMS5232 wrote:as far as dukasaur goes, i had no idea you were so goofy. i mean, you hate your parents so much you'd wish they'd been shot? just move out bro.

Re: Is the Bitcoin bull run over?

Bitcoin is kickin it

$28,312.78

3-19-23

$28,312.78

3-19-23

Re: Is the Bitcoin bull run over?

When you throw in the war, inflation, banking issues, BRICS, open borders and Trump getting arrested higher gold silver and Bitcoin Monday seems easy to see.

- mookiemcgee

- Posts: 5772

- Joined: Wed Jul 03, 2013 2:33 pm

- Gender: Male

- Location: Northern CA

Re: Is the Bitcoin bull run over?

WILLIAMS5232 wrote:as far as dukasaur goes, i had no idea you were so goofy. i mean, you hate your parents so much you'd wish they'd been shot? just move out bro.

Re: Is the Bitcoin bull run over?

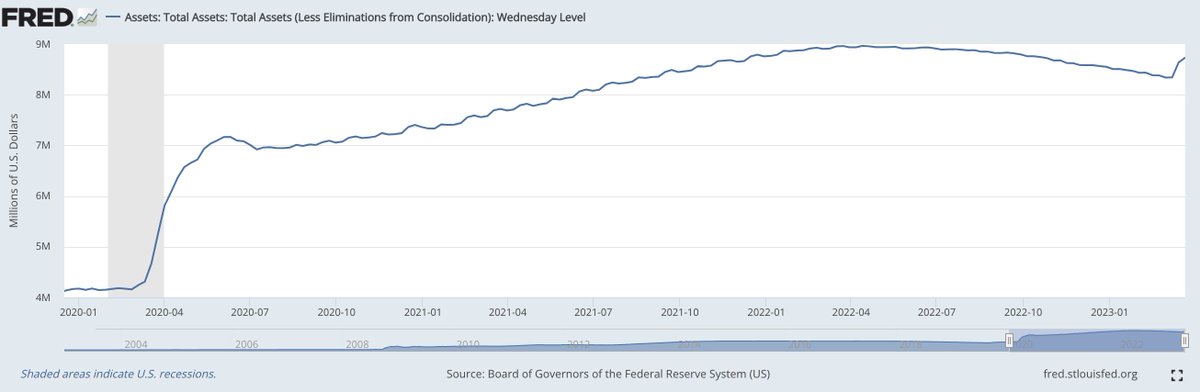

I almost posted that an hour ago. QE

- jimboston

- Posts: 5379

- Joined: Tue Sep 11, 2007 2:45 pm

- Gender: Male

- Location: Boston (Area), Massachusetts; U.S.A.

Re: Is the Bitcoin bull run over?

from the paper…mookiemcgee wrote:If you want to learn more about the USG efforts to undermine the crypto ecosystem, and now 'save' USDC you can read about operation choke point... here one article

https://www.whitecase.com/insight-alert ... mber-banks

You can claim this is an attempt to “undermine” the crypto ecosystem.The Administration Announcement emphasized the need to effectively regulate crypto-assets to protect investors, hold bad actors accountable, and—in explicit reference to the May 2022 "so-called stablecoin" collapse—prevent turmoil in the cryptocurrency sector from spreading to the broader financial system.

Yet wouldn’t stabilizing crypto actually help it?

… also, who really wants or needs a completely untraceable “currency”?

Bad actors for the most part… drug cartels, criminals, hackers, extortionists, terrorists, etc.

Finally… why should we non-crypto crazies care, and allow contagion in the crypto world it spill-over to the “standard” broader financial system?

Re: Is the Bitcoin bull run over?

So the USA banks can give their underwater treasuries to the gov and get 100 par value. So, if you where China then sell them to a friendly USA bank. Have the US bank turn them into the US gov (laundering) and get most of your money back? This could be very expensive to the taxpayer. Maybe into 2 or 3 years the scandal will break. Maybe there are safeguards. Not sure.

- mookiemcgee

- Posts: 5772

- Joined: Wed Jul 03, 2013 2:33 pm

- Gender: Male

- Location: Northern CA

Re: Is the Bitcoin bull run over?

]jimboston wrote:from the paper…mookiemcgee wrote:If you want to learn more about the USG efforts to undermine the crypto ecosystem, and now 'save' USDC you can read about operation choke point... here one article

https://www.whitecase.com/insight-alert ... mber-banksYou can claim this is an attempt to “undermine” the crypto ecosystem.The Administration Announcement emphasized the need to effectively regulate crypto-assets to protect investors, hold bad actors accountable, and—in explicit reference to the May 2022 "so-called stablecoin" collapse—prevent turmoil in the cryptocurrency sector from spreading to the broader financial system.

Yet wouldn’t stabilizing crypto actually help it?

… also, who really wants or needs a completely untraceable “currency”?

Bad actors for the most part… drug cartels, criminals, hackers, extortionists, terrorists, etc.

Finally… why should we non-crypto crazies care, and allow contagion in the crypto world it spill-over to the “standard” broader financial system?

as mentioned before digital assets are inherently 'more traceable' than cash/fiat. Public ledger + actual accounting of supply.

How is the feds telling banks they cannot associate with crypto investments in any way (after writing rules two years earlier to allow it) help to stabilize crypto? These banks aren't even 'investing' in crypto, they are simply holding super safe assets like treasuries on behalf of crypto companies and are being target for it. Who does this protect Jim?

The Feds didn't do anything in May 2022, and then now after crypto had stabilized and was heading back in a good direction they are just straight up attacking banks that have close relationships to crypto. Signature and Silvergate weren't insolvent like SVB and credit Suisse, they were simply targeted because they were the main choke point for exchanging fiat with digital assets. Who are the mysterious 'bad actors' here, a bank holding treasuries for a private company is 'bad'? We aren't talking about drug cartels here, we are talking about Circle who is a fully compliant SEC reporting company all that is fully transparent about the investments backing it's stablecoin.

https://www.circle.com/en/transparency

https://www.wsj.com/articles/signature- ... c-9b825e2e

https://decrypt.co/123346/signature-ban ... rney-frank

(signature bank closed, not due to insolvency. Closed because "Feds wanted to send a message to get people away from crypto.”)

WILLIAMS5232 wrote:as far as dukasaur goes, i had no idea you were so goofy. i mean, you hate your parents so much you'd wish they'd been shot? just move out bro.

- jimboston

- Posts: 5379

- Joined: Tue Sep 11, 2007 2:45 pm

- Gender: Male

- Location: Boston (Area), Massachusetts; U.S.A.

Re: Is the Bitcoin bull run over?

Maybe they don’t want unknown quantities holding Treasuries.

If you don’t like the rules divest and put your money in China.

If you don’t like the rules divest and put your money in China.

- mookiemcgee

- Posts: 5772

- Joined: Wed Jul 03, 2013 2:33 pm

- Gender: Male

- Location: Northern CA

Re: Is the Bitcoin bull run over?

lol, who are the 'unknown quantities' that would be holding treasuries? Circles Board includes the previous CFO of Delta Airlines, former director of the Consumer Financial Protection Bureau, senior partner of Ernst and Young.jimboston wrote:Maybe they don’t want unknown quantities holding Treasuries.

If you don’t like the rules divest and put your money in China.

Barney Frank was on the board of signature bank, you know that guy who wrote the Dodd Frank bill.

The end game here isn't anyone 'divesting to China', such a comment seems to entirely miss the point of crypto as being censorship resistant to any gov'ts desire to control and regulate. It's US citizen/investors who lose the most here, and the US dollar as being the peg/reserve currency in the long term.

WILLIAMS5232 wrote:as far as dukasaur goes, i had no idea you were so goofy. i mean, you hate your parents so much you'd wish they'd been shot? just move out bro.

- jimboston

- Posts: 5379

- Joined: Tue Sep 11, 2007 2:45 pm

- Gender: Male

- Location: Boston (Area), Massachusetts; U.S.A.

Re: Is the Bitcoin bull run over?

Not the board of directors… but if the people holding the crypto want to “cash out” you’d have something similar to a bank run.

The US Dollar has lost some luster… but there’s no viable alternative.

Maybe Gold or other precious metals like HR is selling…. it those fluctuate as well.

The US Dollar has lost some luster… but there’s no viable alternative.

Maybe Gold or other precious metals like HR is selling…. it those fluctuate as well.

- mookiemcgee

- Posts: 5772

- Joined: Wed Jul 03, 2013 2:33 pm

- Gender: Male

- Location: Northern CA

Re: Is the Bitcoin bull run over?

jimboston wrote:Not the board of directors… but if the people holding the crypto want to “cash out” you’d have something similar to a bank run.

The US Dollar has lost some luster… but there’s no viable alternative.

Maybe Gold or other precious metals like HR is selling…. it those fluctuate as well.

Yes, You'd have a bank run created by regulators who shut down rule abiding and solvent banks who were obeying the rules set up by regulators.

bUt ThEy aRE dOIng iT tO pRoTecT iNveSTOrs

WILLIAMS5232 wrote:as far as dukasaur goes, i had no idea you were so goofy. i mean, you hate your parents so much you'd wish they'd been shot? just move out bro.

- jimboston

- Posts: 5379

- Joined: Tue Sep 11, 2007 2:45 pm

- Gender: Male

- Location: Boston (Area), Massachusetts; U.S.A.

Re: Is the Bitcoin bull run over?

Crypto Companies are banks now?

You can’t have it both ways.

You can’t have it both ways.

- jusplay4fun

- Posts: 8381

- Joined: Sun Jun 16, 2013 8:21 pm

- Gender: Male

- Location: Virginia

Re: Is the Bitcoin bull run over?

jimboston wrote:Not the board of directors… but if the people holding the crypto want to “cash out” you’d have something similar to a bank run.

The US Dollar has lost some luster… but there’s no viable alternative.

Maybe Gold or other precious metals like HR is selling…. it those fluctuate as well.

https://www.firstpost.com/explainers/pe ... 46142.html

Petrodollar vs Petroyuan: Can China overthrow US in the global oil market?

China is the world’s biggest crude oil importer and is leveraging that position to make petroyuan the preferred choice for international trade. The move is aimed at denting the US dollar’s hegemony in the global market

FP Explainers March 24, 2023 17:04:08 IST

We are all well aware that all international trade is carried out in dollars. That trend might be seeing a change in recent times with more countries trying to push trade in their currency.

The Indian rupee is also making great strides in this matter, with now 18 countries — Russia, Singapore, Sri Lanka, Botswana, Fiji, Germany, Guyana, Israel, Kenya, Malaysia, Mauritius, Myanmar, New Zealand, Oman, Seychelles, Tanzania, Uganda and the United Kingdom — being allowed to trade in Indian currency and give up dollar as cross-border transaction mode.

Amid these talks and the ongoing Russia-Ukraine war, there is now buzz around the petroyuan. In fact, China has been increasingly pushing the yuan as a currency for oil deals, challenging the dollar’s lead in commodity markets and trying to weaken US hegemony.

JP4Fun

- mookiemcgee

- Posts: 5772

- Joined: Wed Jul 03, 2013 2:33 pm

- Gender: Male

- Location: Northern CA

Re: Is the Bitcoin bull run over?

Banks such as signature bank, with federal charters are banks.jimboston wrote:Crypto Companies are banks now?

You can’t have it both ways.

It's seems like maybe you need to catch up on previous posts before we continue the conversation.

Let me ask you a question Jim, why did Silicon valley bank fail?

Did they make too bad loans that were defaulting?

Did they lose tons of money in crypto?

what was the root cause of their failure?

WILLIAMS5232 wrote:as far as dukasaur goes, i had no idea you were so goofy. i mean, you hate your parents so much you'd wish they'd been shot? just move out bro.

- jimboston

- Posts: 5379

- Joined: Tue Sep 11, 2007 2:45 pm

- Gender: Male

- Location: Boston (Area), Massachusetts; U.S.A.

Re: Is the Bitcoin bull run over?

You are the one comparing Crypto Companies to Banks!mookiemcgee wrote:Banks such as signature bank, with federal charters are banks.jimboston wrote:Crypto Companies are banks now?

You can’t have it both ways.

It's seems like maybe you need to catch up on previous posts before we continue the conversation.

Let me ask you a question Jim, why did Silicon valley bank fail?

Did they make too bad loans that were defaulting?

Did they lose tons of money in crypto?

what was the root cause of their failure?

Why did SVB Fail…there’s no ONE Cause…

*They didn’t have enough liquidity.

*They were over-invested in limited assets and when they went to divest they took losses they couldn’t afford.

*They blindly invested in this limited asset without really considering the basic principal that when interest rates rise the value of this asset is absolutely going to drop… not a problem if you can sit on the asset for long term; a big problem if you need to sell.

*That made these investments with full knowledge that the Fed was going to be raising rates.

*They underestimated the cash flow needs of their customers.

*They had a limited customer base. When the industry that this base lives in started to experience turmoil these customers all jumped to access funds in a ‘herd mentality’ manner.

If you had to pick one cause the answer would be BAD MANAGEMENT.

If you had to pick a secondary cause you could blame the economy in general… but that’s dumb. It’s easy to run a business in a growing economy it’s much harder to maintain in a down market.